This newsletter is brought to you by

THIS WEEK ABROAD

In our penultimate newsletter of 2025, we cover where U.S. expats should (and shouldn’t) establish their domicile. Plus, we have the latest on the new Bulgarian nomad visa.

Check it out in this week’s newsletter.👇

MONEY & TAX CORNER

BEST US STATES FOR EXPAT DOMICILE IN 2026

As a U.S. citizen or resident living abroad, you want to choose your domicile state carefully.

Not all U.S. states are created equally when it comes to taxes, so if you want to optimize your taxes in 2026, keep reading.

• What is a Domicile?

As a reminder, your domicile is your legal, permanent home. It’s the place where you intend to return after any time away. (Note that this is distinct from the legal concept of residency.)

The location of your domicile helps determine which state can claim you for income taxes — a matter of crucial importance for expats trying to optimize taxes while maintaining U.S. ties.

For the uninitiated, make sure you check out our explainer video on Domicile vs. Residence for a full breakdown.

• Best States

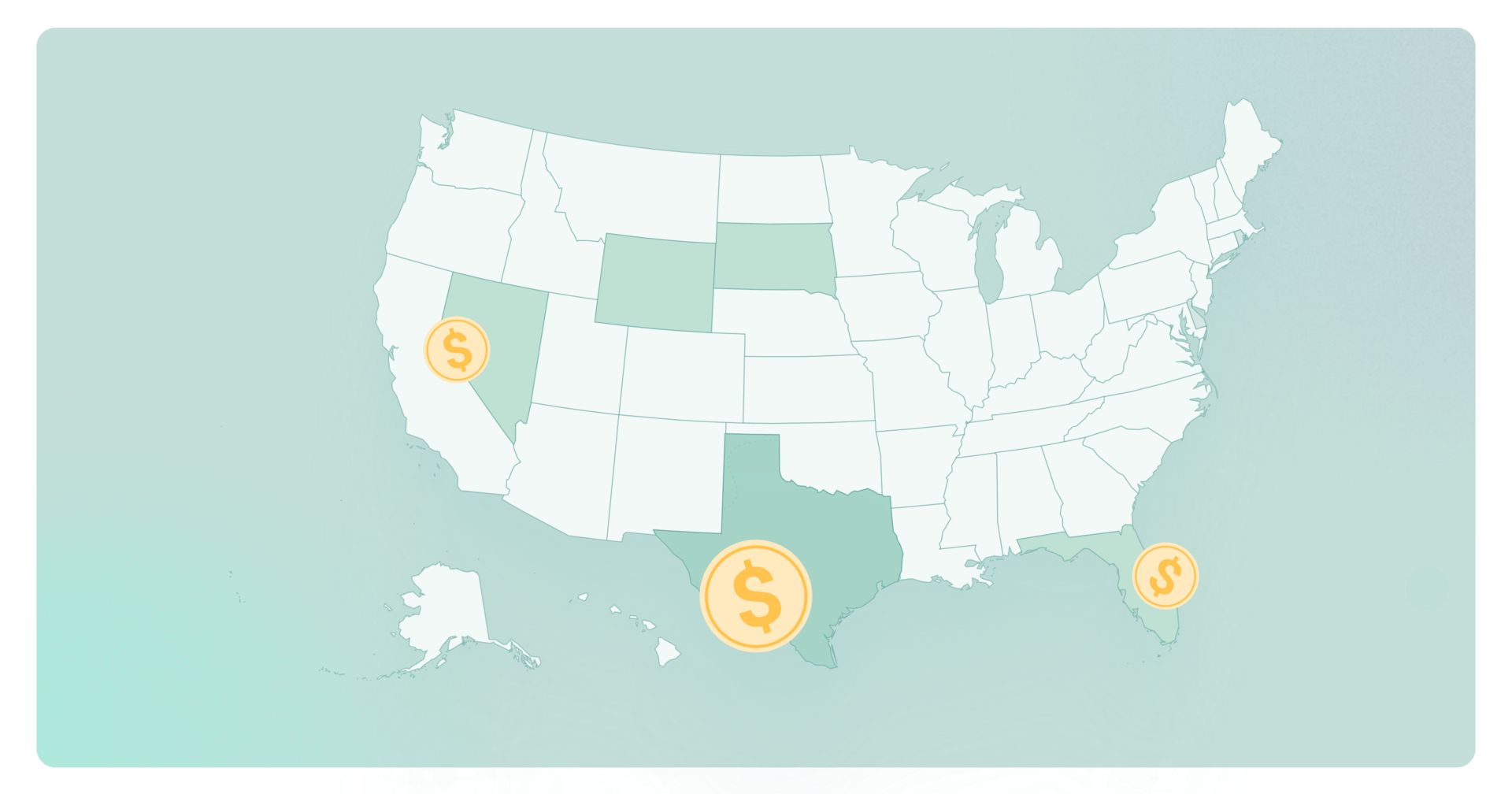

If possible, expats and nomads should aim to establish their domicile in a state with no income tax. As of 2026, there are nine states that fall into this category:

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Of these nine, we think the best four are Florida, South Dakota, Texas, and Nevada because they make it easy to establish a domicile, and there aren’t many extra requirements like vehicle inspections or long minimum stay periods.

• Worst States

In our opinion, the worst states include California, New York, Virginia, Hawaii, and New Jersey. These states impose high tax rates, and they make it particularly difficult to terminate your tax residency.

For a full breakdown of all fifty states, make sure you download our 2026 expat tax guide.

VIDEO OF THE WEEK

⚠️ DON’T FORGET ABOUT FATCA!

If you’re an American living abroad, there’s a good chance that you’ve heard of FATCA. And if you haven’t heard the term, well, now is your chance!

The Foreign Account Tax Compliance Act (FATCA) is one of those laws that expats love to hate. If your foreign financial accounts (including bank and investment accounts, foreign pensions, foreign-issued life insurance with cash value, and ownership interests) exceed $200,000, then you don’t want to miss our latest video.

Residency Radar

BULGARIA LAUNCHES NOMAD VISA

The new Bulgarian digital nomad visa gives non-EU remote workers a legal way to live in the country while working for employers or clients abroad

• Who is eligible?

The visa is open to non-EU/EEA nationals who work remotely, including employees of foreign companies, freelancers with overseas clients, and owners or managers of businesses based outside Bulgaria.

• Requirements

Proof of remote work (employment contract, client agreements, or company ownership documents).

Annual income equal to at least 50 times Bulgaria’s minimum monthly wage (roughly €28,000).

Valid international health insurance.

Clean criminal record.

Proof of accommodation in Bulgaria.

Valid passport.

The permit is typically granted for one year, with the option to renew.

Applicants generally begin the process by applying for a Type D long-stay visa through a Bulgarian consulate, followed by a residence permit after arrival.

This newsletter is brought to you by SavvyNomad

Save an extra 4%-14.8% of your annual income with tax-savvy strategies. Change your domicile in the US: let Savvy Nomad help with the hassle.